The Board of Trustees of the Kansas Methodist Foundation, after an extensive review through the last six months, voted to adjust the asset allocation for both the Balanced Fund and Equity Fund, effective October 1, 2024. The allocation adjustments will reduce the investments in international equities in both funds, and will integrate more use of an index fund for the U.S. equity portion. The Board believes that these modifications will help KMF better meet the needs of the churches and agencies in Kansas, as well as slightly reduce the risk of the two funds.

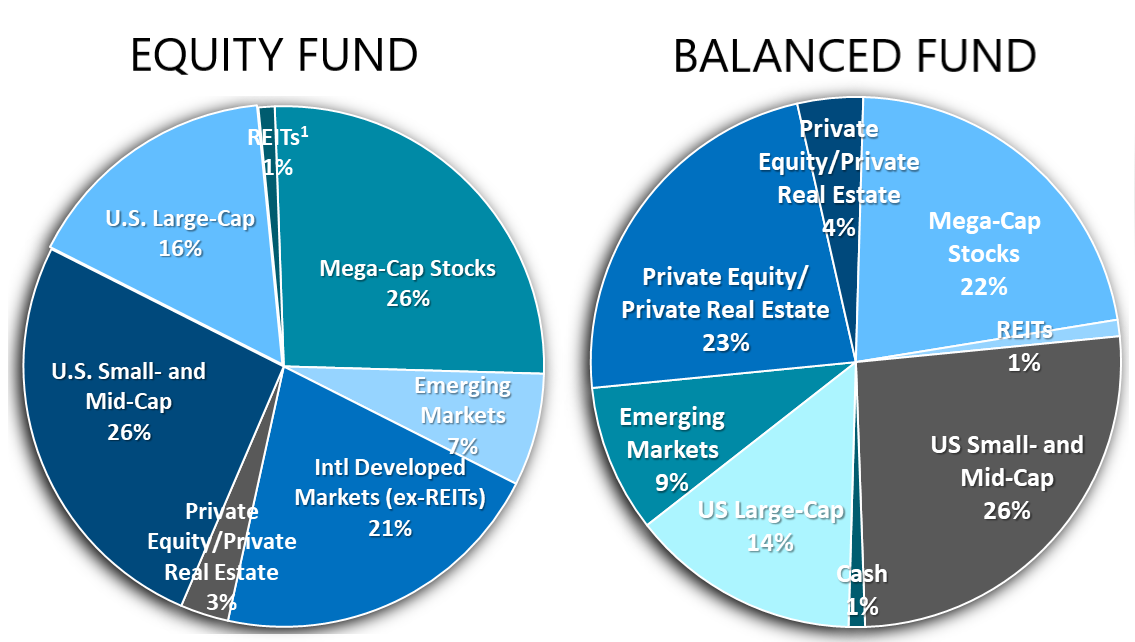

The new asset allocation for the Balanced Fund offered through KMF is as follows:

25% US Equity Fund,

20% US Equity Index Fund,

20% International Equity, and

35% Fixed Income Fund.

The new asset allocation for the Equity Fund offered through KMF is as follows:

40% US Equity Fund,

30% US Equity Index Fund, and

30% International Equity.

If you have questions about this change or would like to visit about modifying your asset allocation, please contact us. We seek to continue to offer strong investment options that serve your ministry well. We also welcome your feedback for how we can continue to improve. You can contact Gloria (gloria@kansasmethodistfoundation.org) or Dustin (dustin@kansasmethodistfoundation.org).