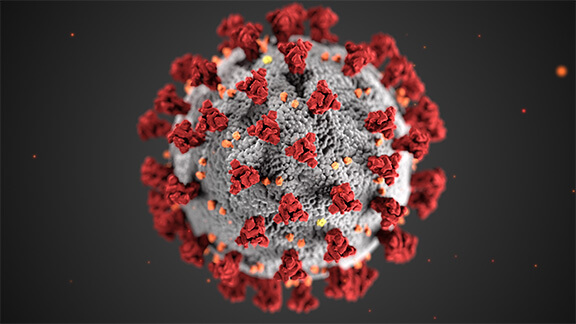

Our goal is to help you and your church navigate the challenging time as a result of COVID-19. Below is a list a resources to help as we go through this together. To read the response from President Dustin Petz, click here.

1. Establish reoccurring and online giving options. A few possible providers are:

• VANCO — Go to www.vancopayments.com – Vanco has been supporting electronic giving for churches for more than 20 years and is recommended by the Great Plains Conference administrative staff. In response to the COVID-19 crisis, any UMC church that enrolls with Vanco now will see the monthly fee for the Start Plan waived for a full year; those that enroll with the Sustain Plan will see that monthly fee waived for the first 3 months.

• Stripe — This online platform allows a local church to accept offerings and tithes.

• Paypal — This platform gives customers a fast, easy checkout process and accepts payment methods such as credit cards, debit cards, and Venmo.

• Tithe.ly — This giving platform was developed especially for churches.

2. When engaging the congregation speak to purpose & mission – this is a key reason people give.

Be clear about how people are making a difference through their giving.

...through the various emergency service ministries

...through technology to allow people to connect through worship and other ministries, etc.

3. Ask people to continue to give. A personal ask make a tremendous difference.

Directly engaging givers, especially the lead giving families, to consider making their gifts to the church earlier in the year or to give more to help the church and those families unable to give because of circumstances. A personal expression of thanks and ask can be very vital.

4. Take practical actions to reduce unnecessary costs to help make the gift given go further. If there are multiple efforts to do our mission and make a lasting difference in our community, we are encouraged in our giving.

5. Are there any reserve funds that can be used – Emergency Funds?

6. CDs and other bank deposits are paying a very limited return – consider using these for sustaining operations giving to church in short term.

7. Invite people who are 70 ½ years old or older with Traditional IRAs to make Qualified Charitable Distributions to the church.

8. Invite people to consider deploying Donor Advised Funds to the church for this urgent need.

1. Look into the new CARES Act. Applications start April 3. Click here for the application.

2. Off-set Payroll - have some staff paid on 1st and 3rd weeks, with others on 2nd and 4th weeks. This can work to reduce spikes of cash needs. One example is for the pastor to be paid on alternating weeks from the other staff.

3. Engage major expense providers and see about delaying payment for bills or make a payment plan – discover if there is a fee for this.

4. Furlough staff – partially to keep jobs, but reduce expenses to be sustainable. Maybe make a few staff ½ time for a few months.

5. Reduce staff to be sustainable long-term. If the budget was already not sustainable, then the crisis may force the church to reexamine how best to move forward in the long-term. This and the next option ought to be last resort options.

6. Possible Line of Credit to provide finances in the short-term. There needs to be a strategy and sufficient ability to repay these in the coming months.

1. Hold fast to a long-term, disciplined strategy for investments. Markets go up and down, but a prudent practice is to look at the long-term processes and make sound decisions.

2. Be very cautious to change asset allocations at this stage. If we are late into the drawdown, then do not try to adjust. Too often people panic, and sell equities late into a drawdown, and then do not get reinvested in time to take advantage of the recovery.

3. Consider ways to learn from the current crisis and as needed commit to creating a healthier system in the future. One aspect of this is to have sufficient reserves so that selling equities at the most inopportune time does not happen.

4. Click here to watch a video from Wespath’s Chief Investment Officer.

1. Endowments are enduring gifts given by donors to further ministry for generations to come. If endowments are designated or restricted by the donor for a specific purpose, they are to be use for that specific purpose. It is a breach of trust to do otherwise. All steps necessary to keep from breaking this promise ought to be deployed.

2. Some endowments and designated funds were designated by a church board and not by the donor of the gift. If a church board has made the designation and verification can be made from the original documents, then today’s church board could act to remove the restriction or change the designation. Sometimes a designation is placed on funds that were not original to the donor. An example of this might be a church that decided to honor a member by using the resources in a way that was close that member’s passion, but this was done without any designation or restriction by the donor. In such situations, the designations or restrictions can be changed by proper actions of the Board of Trustees or Permanent Endowment and Planned Giving Ministry Committee (see BOD Paragraph 2534).

3. In some congregations, the Charter related to the Permanent Endowment Program (if one is established) can clarify how endowments may be used in challenging times. Ideally, the Charter will answer for the congregation options for times when money is needed or when there is a total encumbrance and the survival of the church is at stake. Some churches allow borrowing from endowments, or allowing endowments to serve as collateral for a loan, or even using undesignated endowments to survive in a crisis. Other churches resist using endowments for such situations. Having a clear charter helps the church in the midst of such challenging times.

4. Necessary steps need to be taken to protect the intent of the donor and to honor their gift. In some limited situations there are legal ways to release or modify the restrictions of a gift or endowment, however, they are not simple or quick, and legal counsel is needed.

• Great Plains Conference Giving Resources Click here

• UMC Discipleship Equipping Leaders. Click here

• Faith & Leadership’s Resources for Christian leaders during the coronavirus pandemic. Click here

• Tithe.ly’s Ten Ways to To Keep Your Church Healthy and Discipled During the Outbreak. Click here