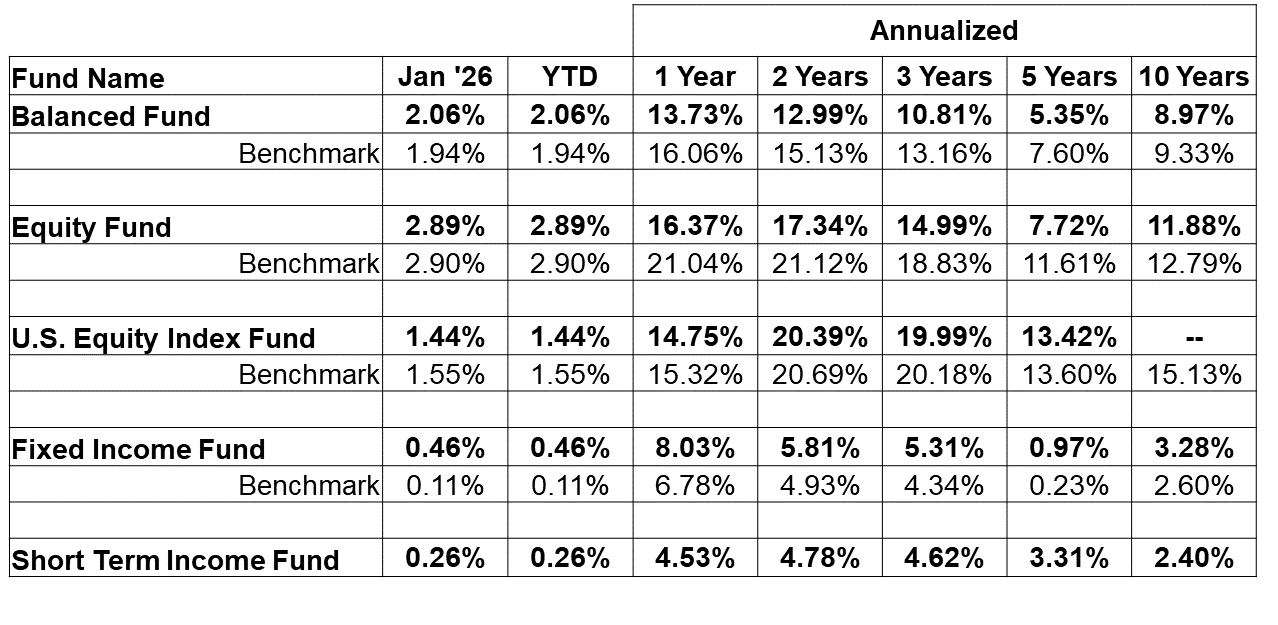

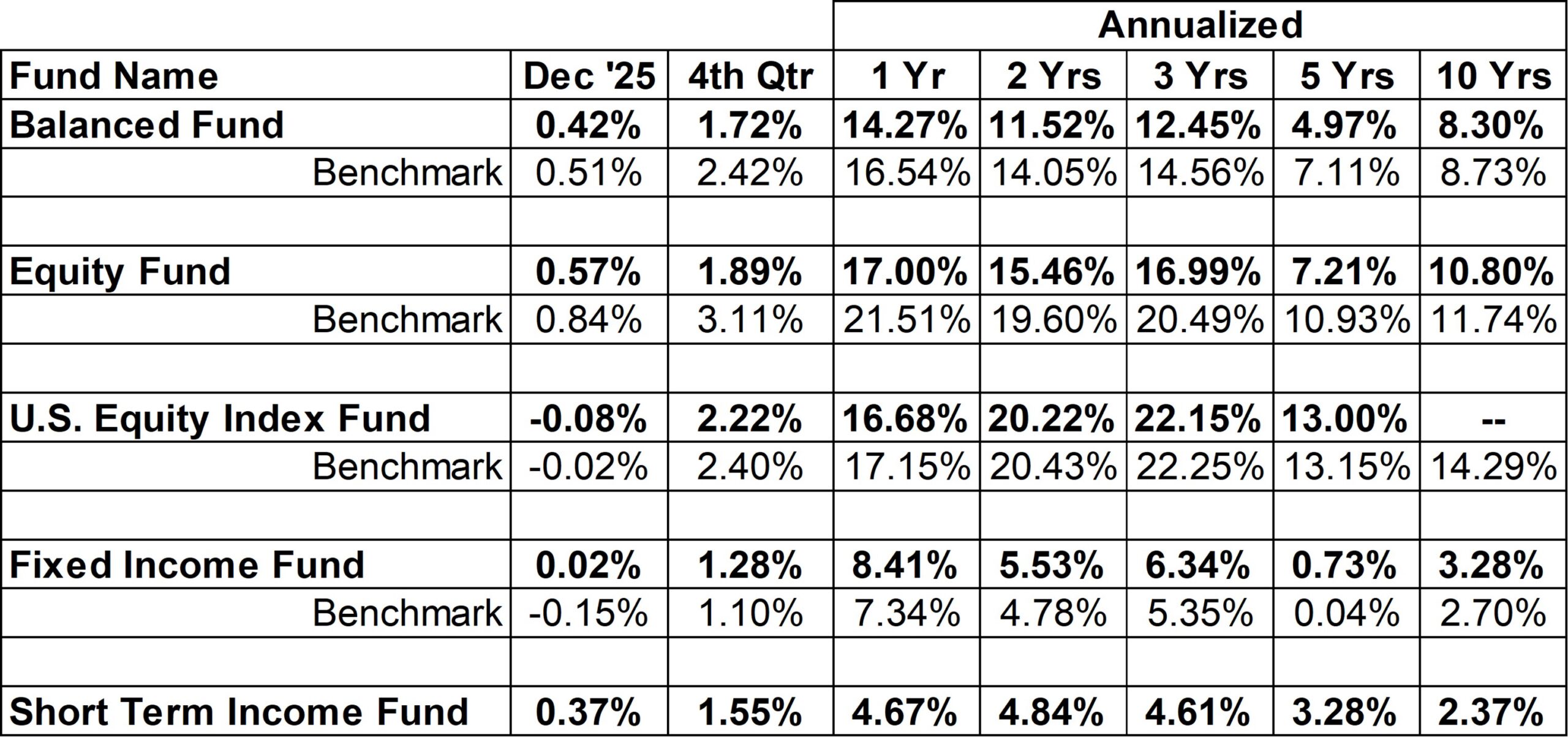

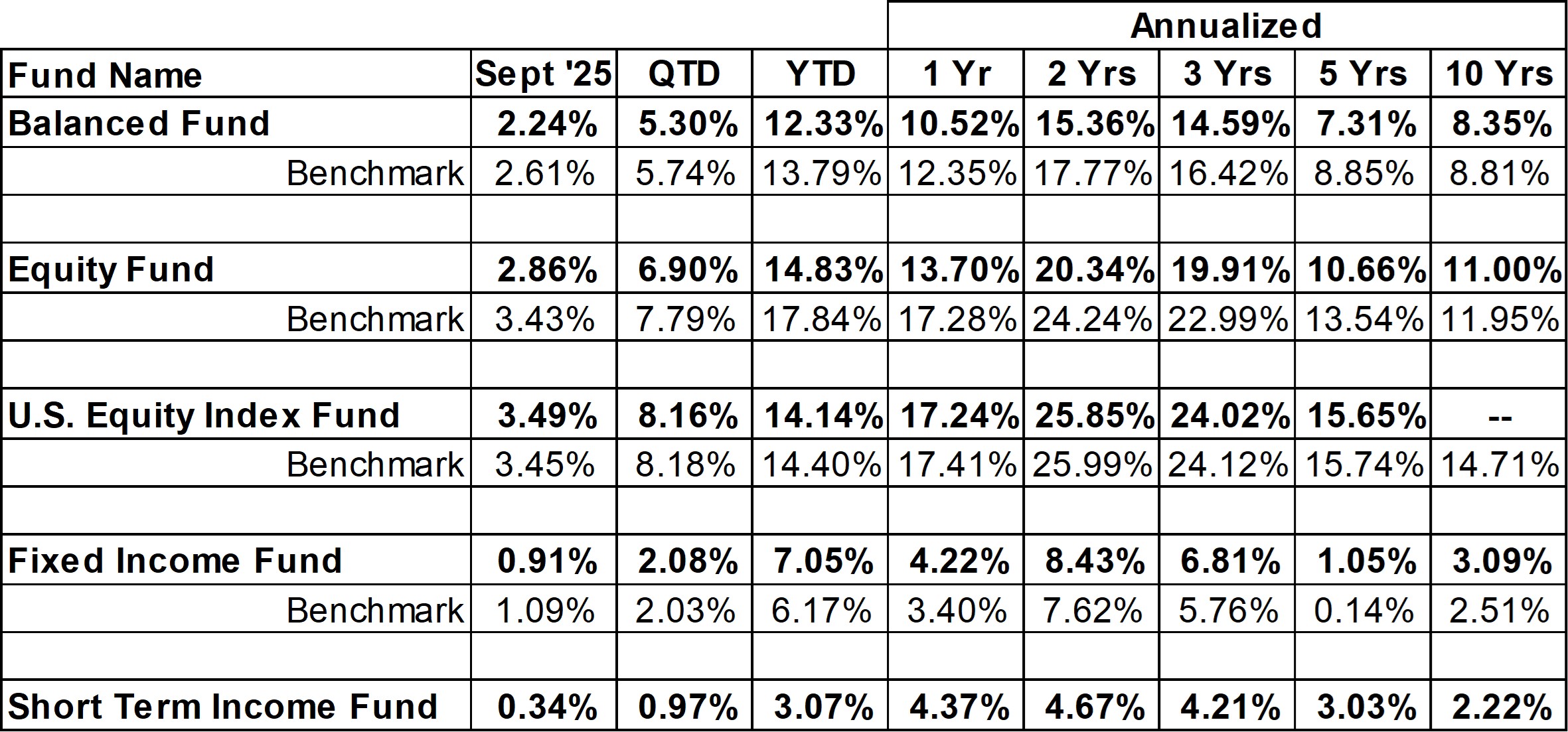

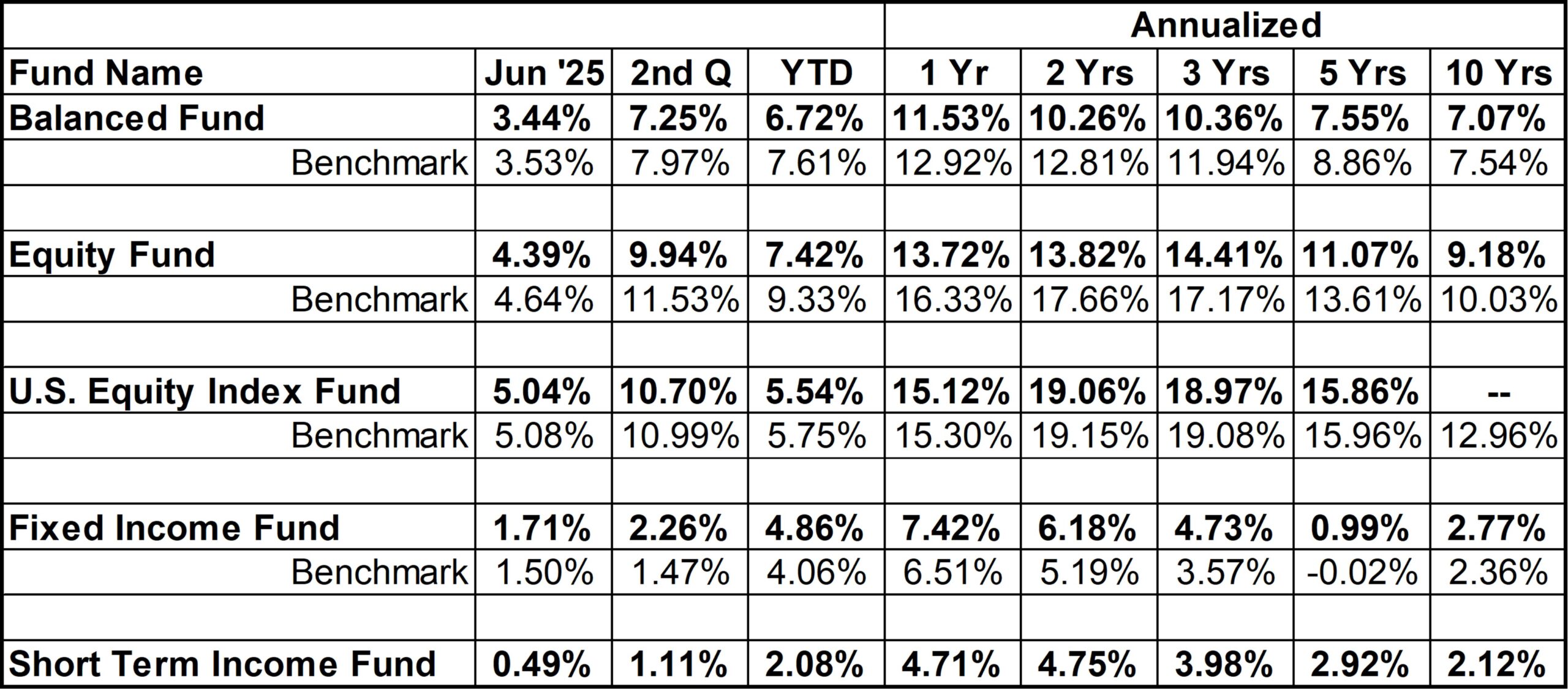

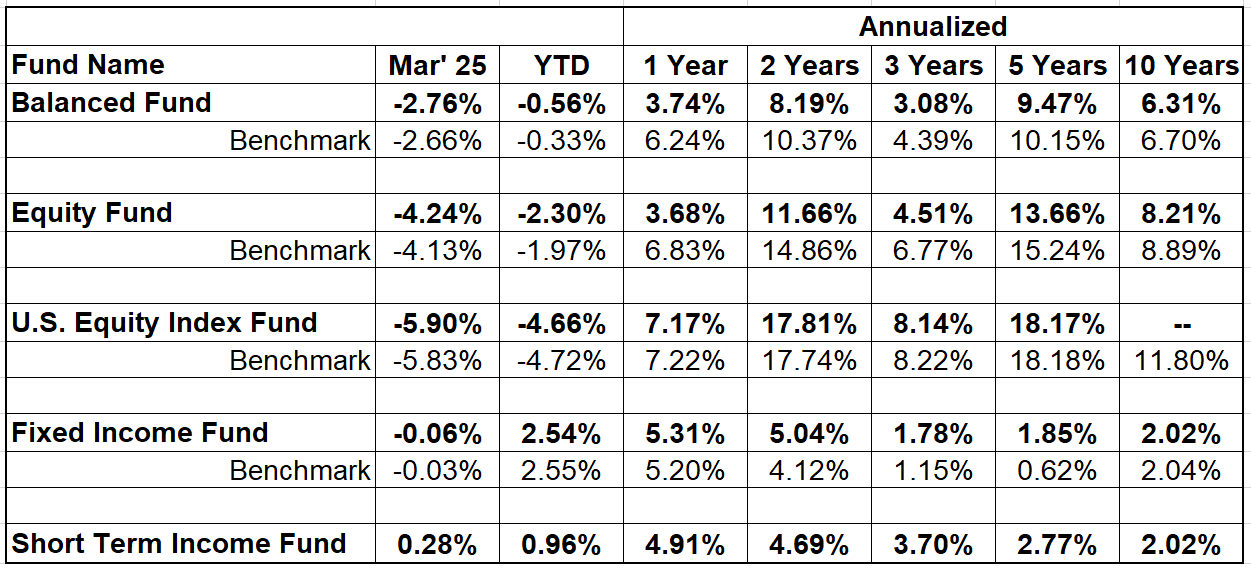

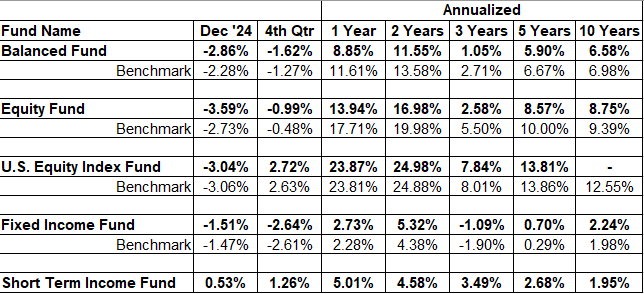

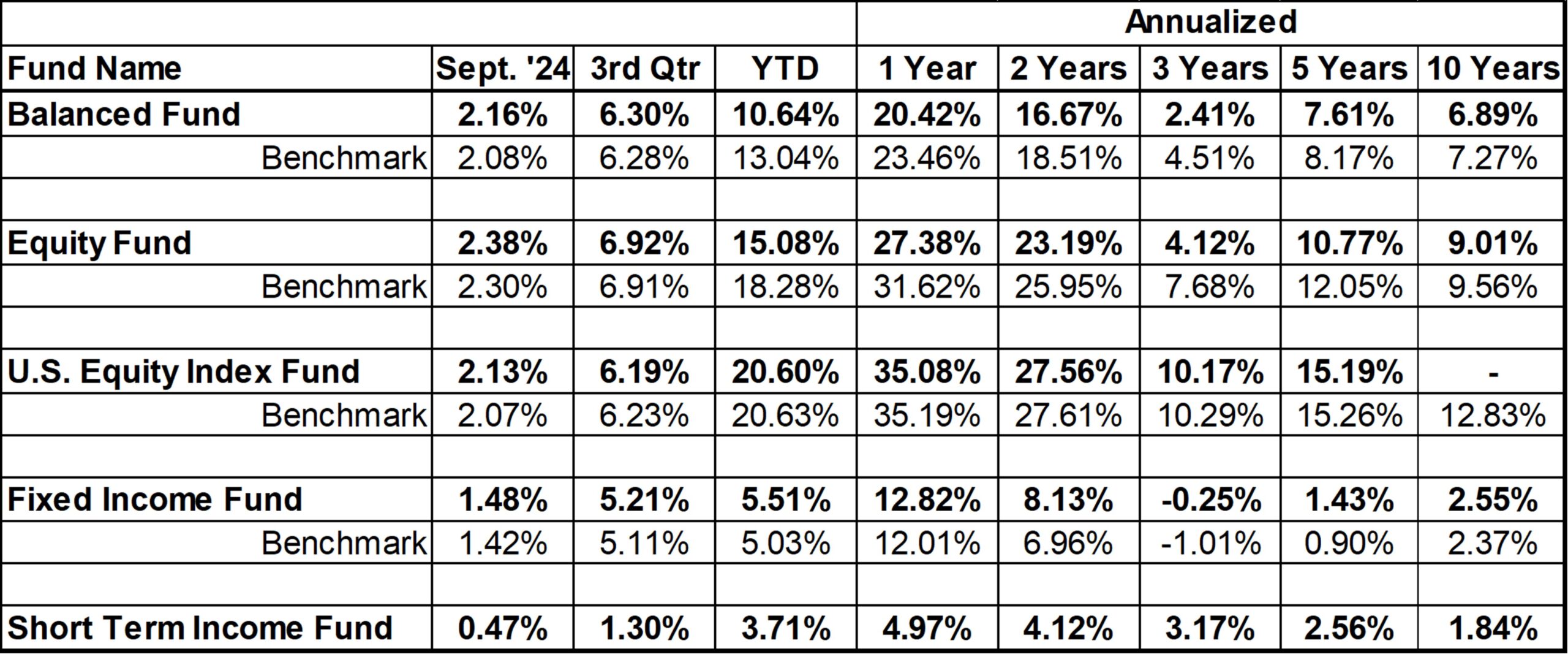

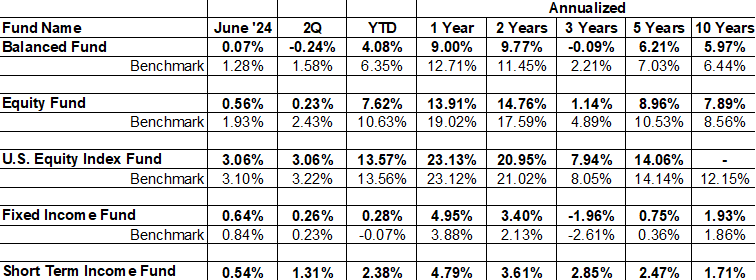

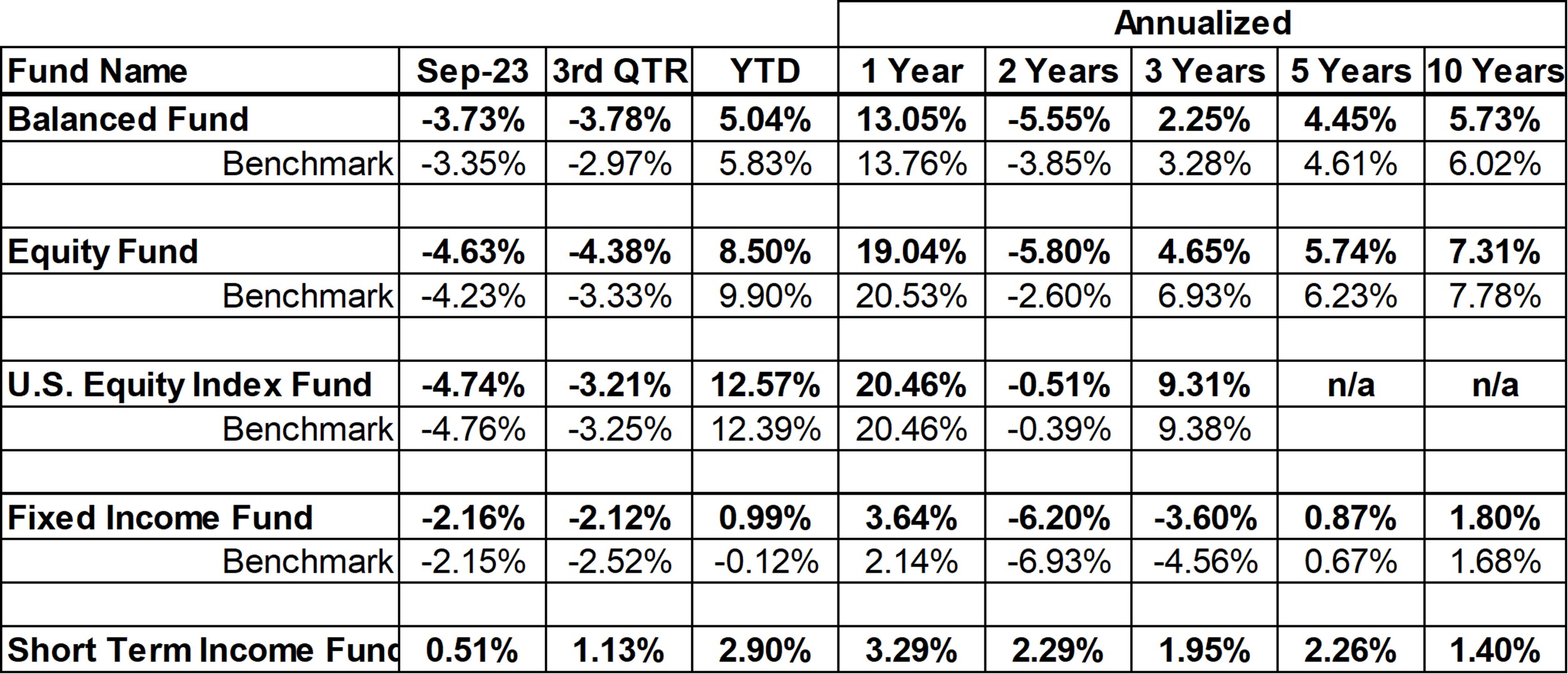

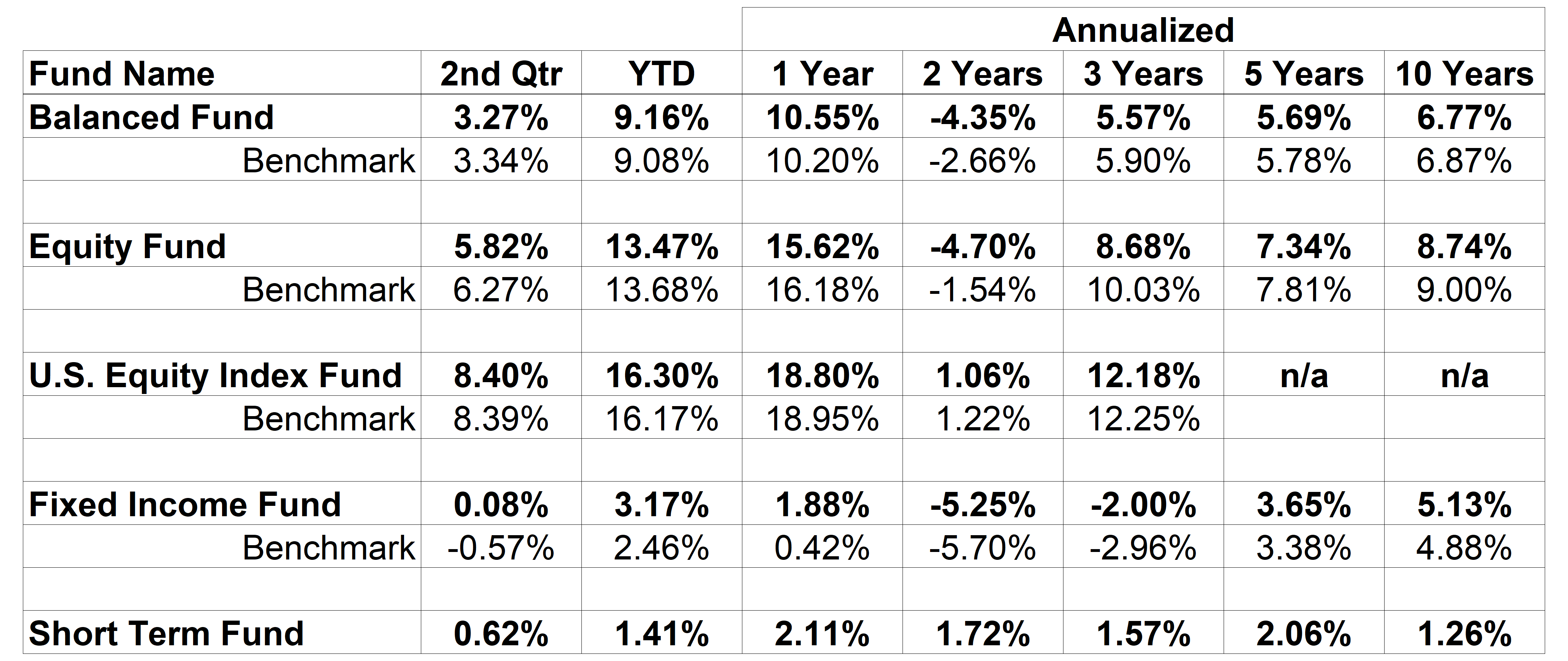

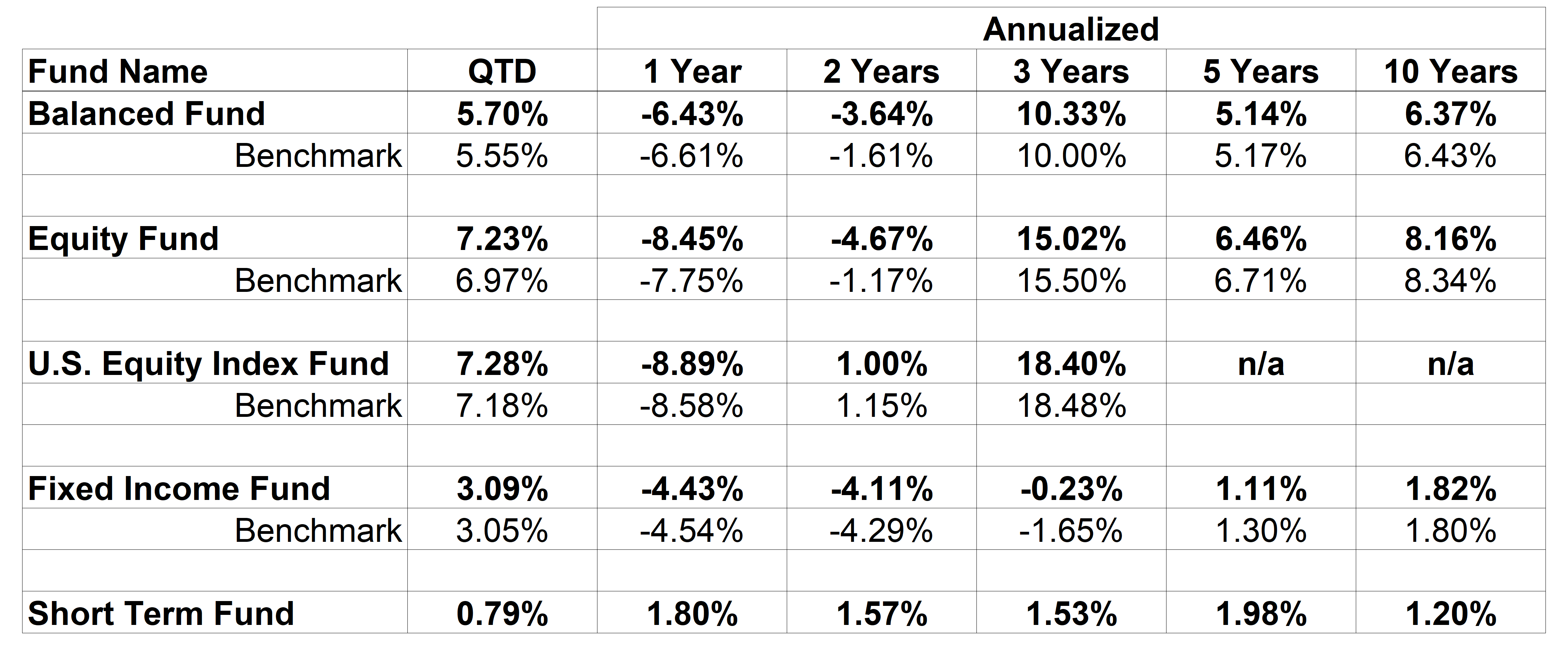

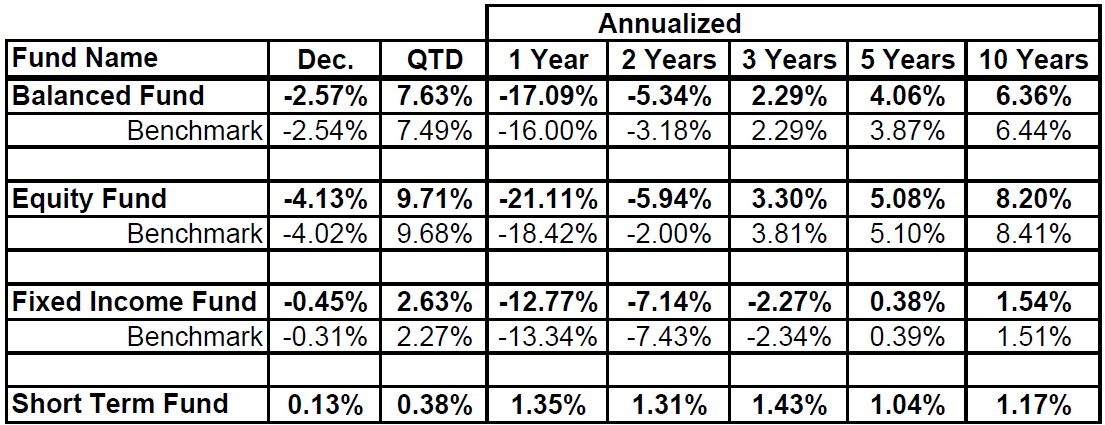

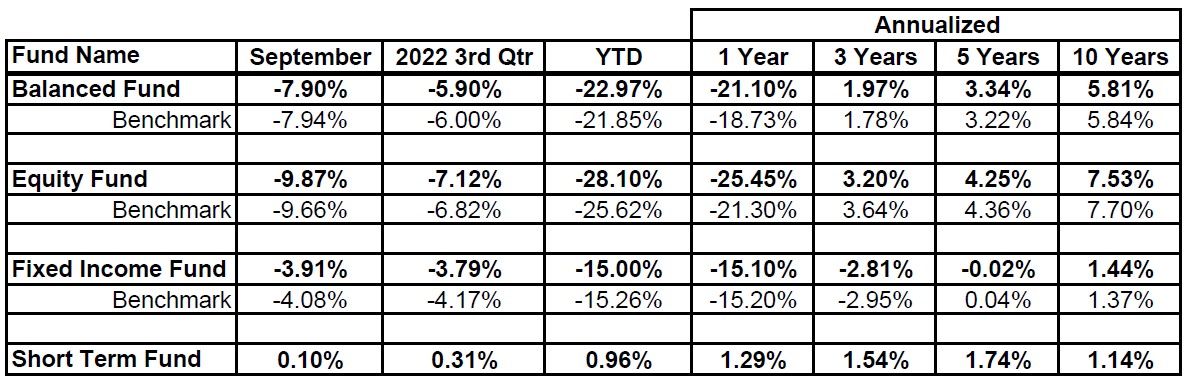

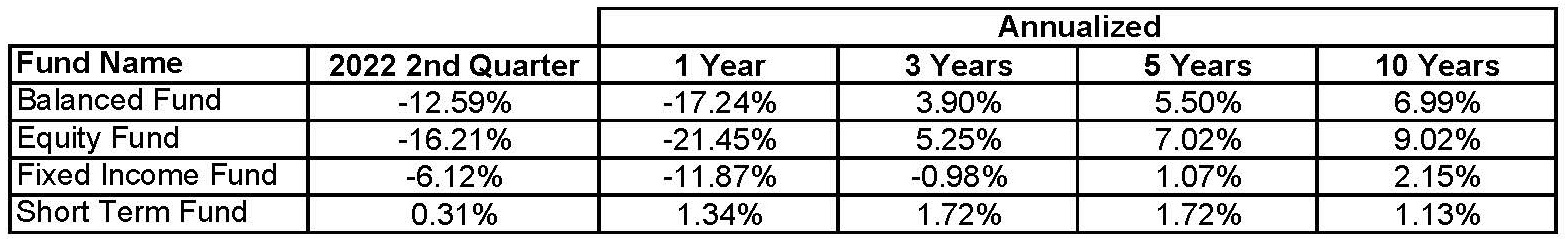

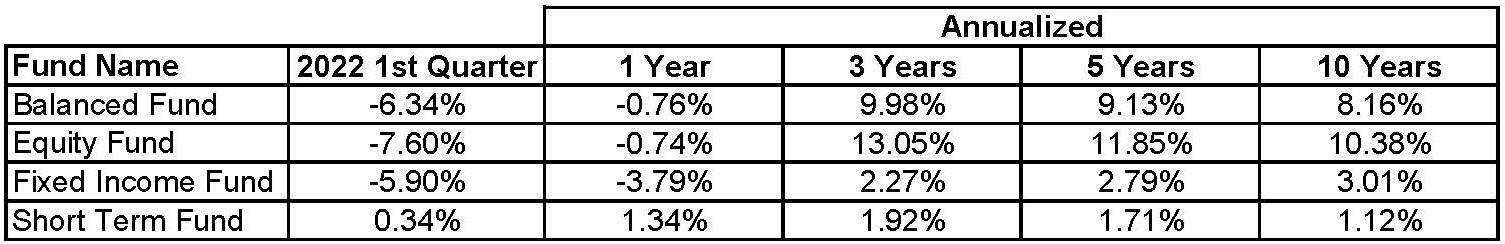

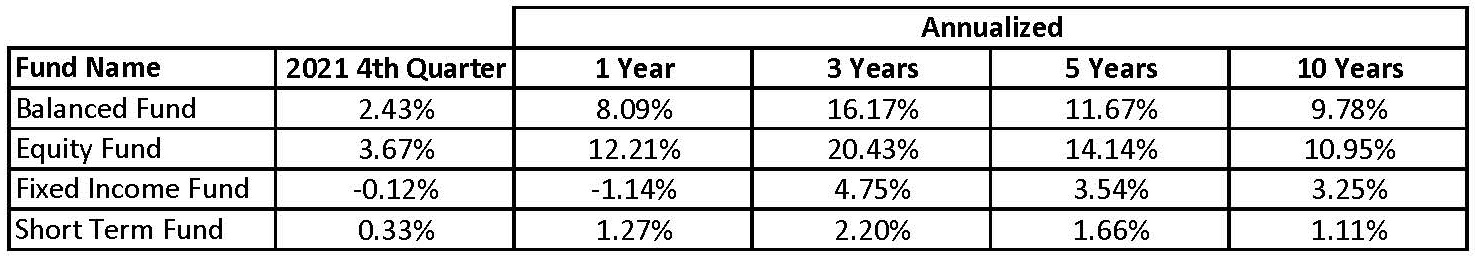

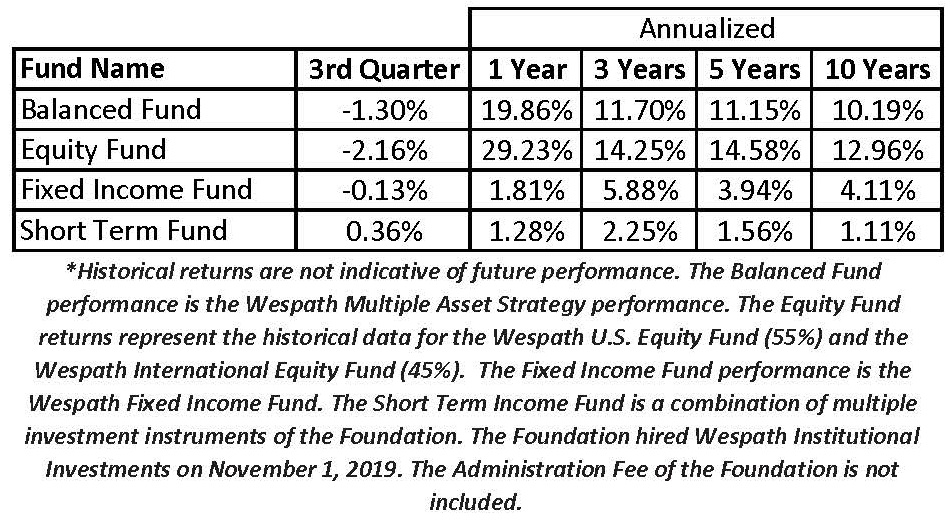

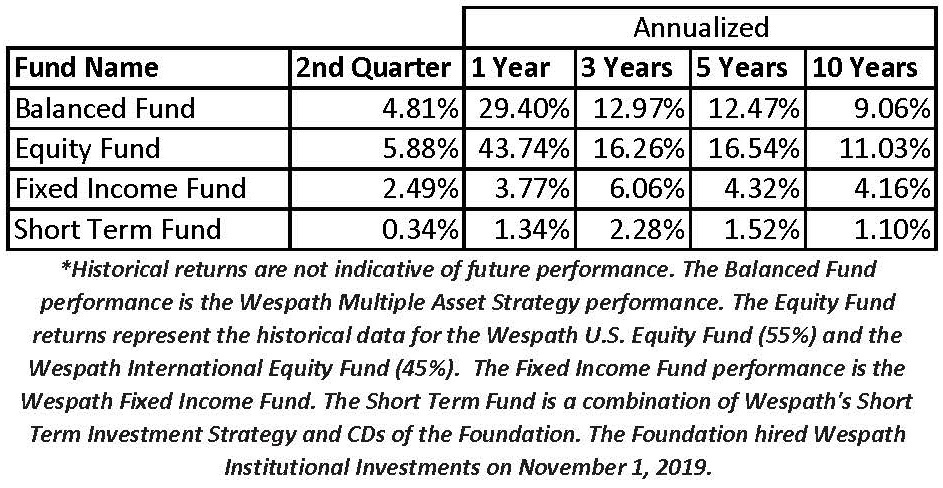

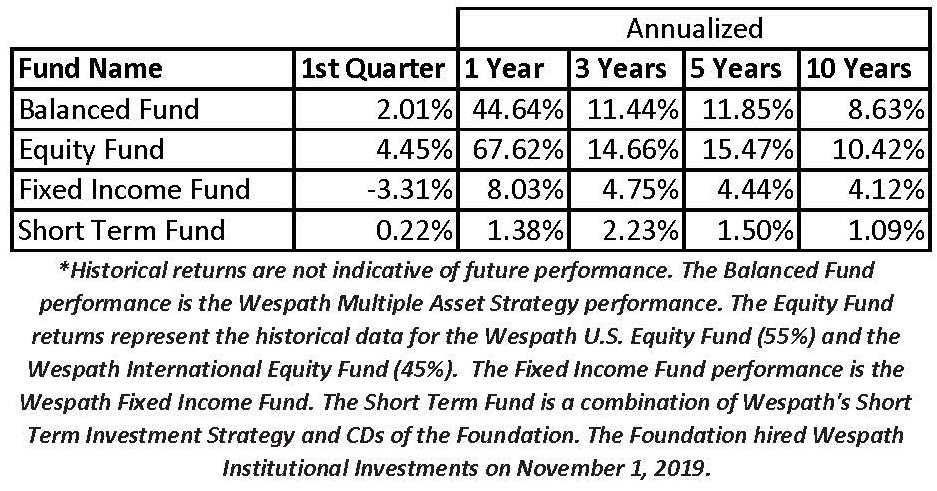

Quarterly Update on KMF Funds from Wespath Institutional Investments

*Historical returns are not indicative of future performance. The Balanced Fund performance is the Wespath Multiple Asset Strategy performance. The Equity Fund returns represent the historical data for the Wespath U.S. Equity Fund (55%) and the Wespath International Equity Fund (45%) until October 2022, when the asset allocation changed to Wespath U.S. Equity Fund (45%), Wespath U.S. Equity Index Fund (20%), and Wespath Interntional Equity Fund (35%). The U.S. Equity Index Fund is the Wespath U.S. Equity Index Fund. The Fixed Income Fund performance is the Wespath Fixed Income Fund. More information about the funds and benchmarks can be found at https://www.wespath.com/funds. The Short Term Income Fund is a combination of multiple investment instruments of the Foundation. The Foundation hired Wespath Institutional Investments on November 1, 2019. The Administration Fee of the Foundation is not included.